AI Trends in Financial Services

Artificial intelligence (AI) empowers financial services organizations to transform customer experiences by building trust and enhancing customer loyalty to gain a competitive advantage.

Learn how AI is evolving across the industry—and how Lumen can help support advanced technology to empower your business.1

Here’s why financial services are turning to AI.

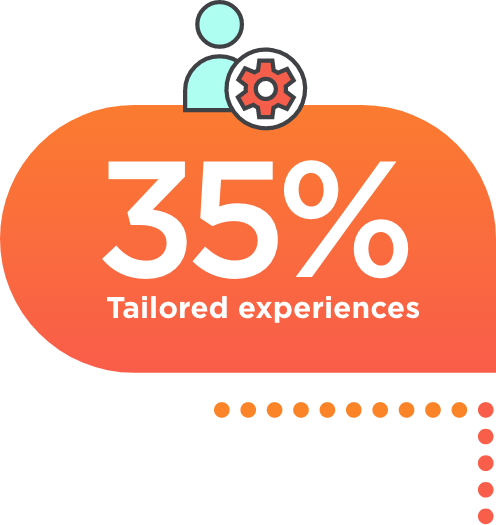

35% of financial services decision makers say creating personalized experiences for customers is the most important outcome of IT transformation

AI can define customer segments based on behavior, preferences, financial goals and life stages, enabling customized offers and financial advice.

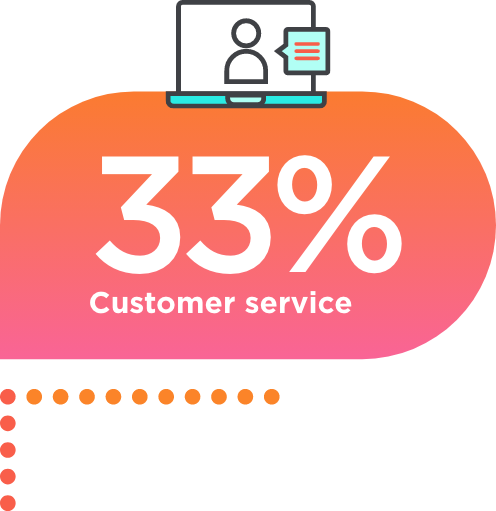

33% of financial services organizations have implemented AI-enabled technologies for customer service

AI-powered chatbots and virtual assistants can answer questions and offer financial guidance anytime without the need for human intervention.

41% of financial services organizations have built capabilities to detect and respond to cybersecurity incidents in real time

Institutions promote trust by integrating AI into fraud detection processes to analyze vast amounts of data and identify anomalies.

61% of financial services organizations plan to invest in AI-enabled technologies in the next year

Finance organizations can use machine learning (ML) to analyze data, forecast market trends, build predictive models and optimize portfolios.

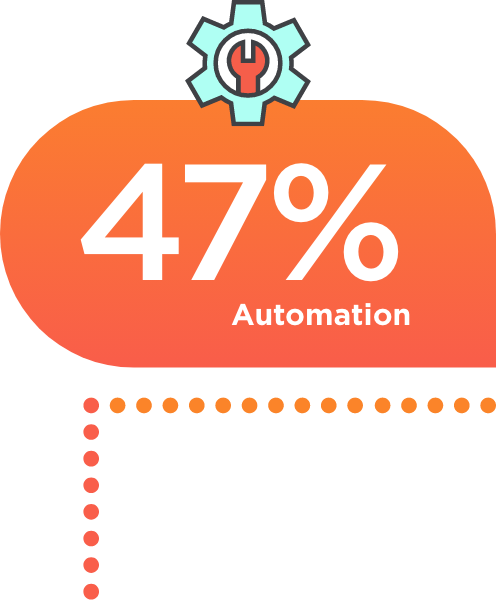

47% of financial services organizations have automated routine tasks for employees

AI streamlines internal processes such as account creation and data reconciliation, reducing costs, minimizing errors and freeing resources to focus on strategic activities.

Having a supportive network is key

AI is helping meet finance customer needs intelligently and conveniently—but it may also place additional strain on a company’s network resources.

The Lumen network supports the dynamic demands of AI-powered technologies by providing high-capacity connections, deep IP peering and AIOps to leverage AI/ML apps without the constraints of a traditional network.

Here’s why financial services are turning to AI.

Here’s why financial services are turning to AI.

35% of financial services decision makers say creating personalized experiences for customers is the most important outcome of IT transformation

AI can define customer segments based on behavior, preferences, financial goals and life stages, enabling customized offers and financial advice.

33% of financial services organizations have implemented AI-enabled technologies for customer service

AI-powered chatbots and virtual assistants can answer questions and offer financial guidance anytime without the need for human intervention.

27% have a need for quicker provisioning

Activate new connections or deactivate unneeded ones in just a few clicks with Lumen® Internet On-Demand.

41% of financial services organizations have built capabilities to detect and respond to cybersecurity incidents in real time

Institutions promote trust by integrating AI into fraud detection processes to analyze vast amounts of data and identify anomalies.

42% want higher caliber, more reliable services

Confidently connect to data centers and private and public clouds on the Lumen IP backbone with our 99.99% service availability SLA.

61% of financial services organizations plan to invest in AI-enabled technologies in the next year

Finance organizations can use machine learning (ML) to analyze data, forecast market trends, build predictive models and optimize portfolios.

47% of financial services organizations have automated routine tasks for employees

AI streamlines internal processes such as account creation and data reconciliation, reducing costs, minimizing errors and freeing resources to focus on strategic activities.

Having a supportive network is key

AI is helping meet finance customer needs intelligently and conveniently—but it may also place additional strain on a company’s network resources.

The Lumen network supports the dynamic demands of AI-powered technologies by providing high-capacity connections, deep IP peering and AIOps to leverage AI/ML apps without the constraints of a traditional network.

35% of financial services decision makers say creating personalized experiences for customers is the most important outcome of IT transformation

AI can define customer segments based on behavior, preferences, financial goals and life stages, enabling customized offers and financial advice.

33% of financial services organizations have implemented AI-enabled technologies for customer service

AI-powered chatbots and virtual assistants can answer questions and offer financial guidance anytime without the need for human intervention.

27% have a need for quicker provisioning

Activate new connections or deactivate unneeded ones in just a few clicks with Lumen® Internet On-Demand.

41% of financial services organizations have built capabilities to detect and respond to cybersecurity incidents in real time

Institutions promote trust by integrating AI into fraud detection processes to analyze vast amounts of data and identify anomalies.

42% want higher caliber, more reliable services

Confidently connect to data centers and private and public clouds on the Lumen IP backbone with our 99.99% service availability SLA.

61% of financial services organizations plan to invest in AI-enabled technologies in the next year

Finance organizations can use machine learning (ML) to analyze data, forecast market trends, build predictive models and optimize portfolios.

47% of financial services organizations have automated routine tasks for employees

AI streamlines internal processes such as account creation and data reconciliation, reducing costs, minimizing errors and freeing resources to focus on strategic activities.

Having a supportive network is key

AI is helping meet finance customer needs intelligently and conveniently—but it may also place additional strain on a company’s network resources.

The Lumen network supports the dynamic demands of AI-powered technologies by providing high-capacity connections, deep IP peering and AIOps to leverage AI/ML apps without the constraints of a traditional network.

1Foundry Research, Navigating Change: IT Transformation Trends in Financial Services and Retail, March 2024.